NPV is often used in company valuation – check out the discounted cash flow calculator for more details. Because there are two types of annuities (ordinary annuity and annuity due), there are two ways to calculate present value. You can solve for all four variables involved in present value of annuity calculation viz. Unlike spreadsheets and financial calculator models, there is no convention of using negative numbers. Enter only positive values in this present value of annuity calculator.

Evolution of Present Value of Annuity Calculation

- In order to receive the monthly updates, all three boxes must be checked in the Terms, Privacy Policy, and Consent section.

- On this page, you can calculate present value of annuity (PVA) of both simple as well as complex annuities.

- Consider, for argument purposes, that two people Mr. Cash, and Mr. Credit have won the same lottery of $1,000 per month for the next 20 years.

- Suppose a person buys a house and amortizes the loan over 30 years, but decides to sell the house a few years later.

- Other factors, such as your long-term financial goals, when you hope to retire, and your personal level of risk tolerance might also influence whether investing in an annuity is right for you.

- The present value (PV) of an annuity is the discounted value of the bond’s future payments, adjusted by an appropriate discount rate, which is necessary because of the time value of money (TVM) concept.

It is a method for calculating the present value of a series of future payments. This formula is used to determine how much money you should invest today in order to receive a certain amount of money in the future. To put it simply, any financial product that involves a series of payments made at equal intervals is an annuity.

How to calculate net present value?

The best way to demonstrate the strengths of the annuity calculator is to take some annuity examples. In this case, the person should choose the annuity due option because it is worth $27,518 more than the $650,000 lump sum. For a present value of $1000 to be paid one year from the initial investment, at an interest rate of five percent, the initial investment would need to be $952.38. Although this approach may seem straightforward, the calculation may become burdensome if the annuity involves an extended interval. Besides, there may be other factors to be considered that further obscure the computation. If you read on, you can study how to employ our present value annuity calculator to such complicated problems.

Alternative Methods for Measuring Present Value of Annuity Calculation

The calculation can only be as accurate as the input assumptions – specifically the discount rate and future payment amount. The internal rate of return (IRR calculator) of a project is such a discount rate at which the NPV equals zero. In other words, the company will neither earn nor lose on such a project – the gains are equal to costs. Our online tools will provide quick answers to your calculation and conversion needs.

Over the course of the loan, she would pay $934.13 every month for 60 months. Note that my expertise is in creating online calculators, not necessarily in all of the subject areas they cover. While am i insolvent the signs of insolvency for small businesses I do research each calculator’s subject prior to creating and upgrading them, because I don’t work in those fields on a regular basis, I eventually forget what I learned during my research.

Two Types of Annuities

This formula is commonly used in corporate finance and banking, but is equally useful in personal or household financial calculations. The effects of compound interest—with compounding periods ranging from daily to annually—may also be included in the formula. Plots are automatically generated to show at a glance how present values could be affected by changes in interest rate, interest period or desired future value. The Present Value of Annuity calculation formula is one of the most important concepts in finance.

Something to keep in mind when determining an annuity’s present value is a concept called “time value of money.” With this concept, a sum of money is worth more now than in the future. By taking the time to calculate the present value of an annuity, you can decide whether or not investing in an annuity will be in your financial best interest. For example, once the time value of money (TVM) is accounted for, you can see whether it makes sense to allocate your money to a different type of financial asset or to annuities. Calculate the present value of an annuity by entering the payment, term, rate, and type of annuity in the calculator below. You should consider the annuity calculator as a model for financial approximation.

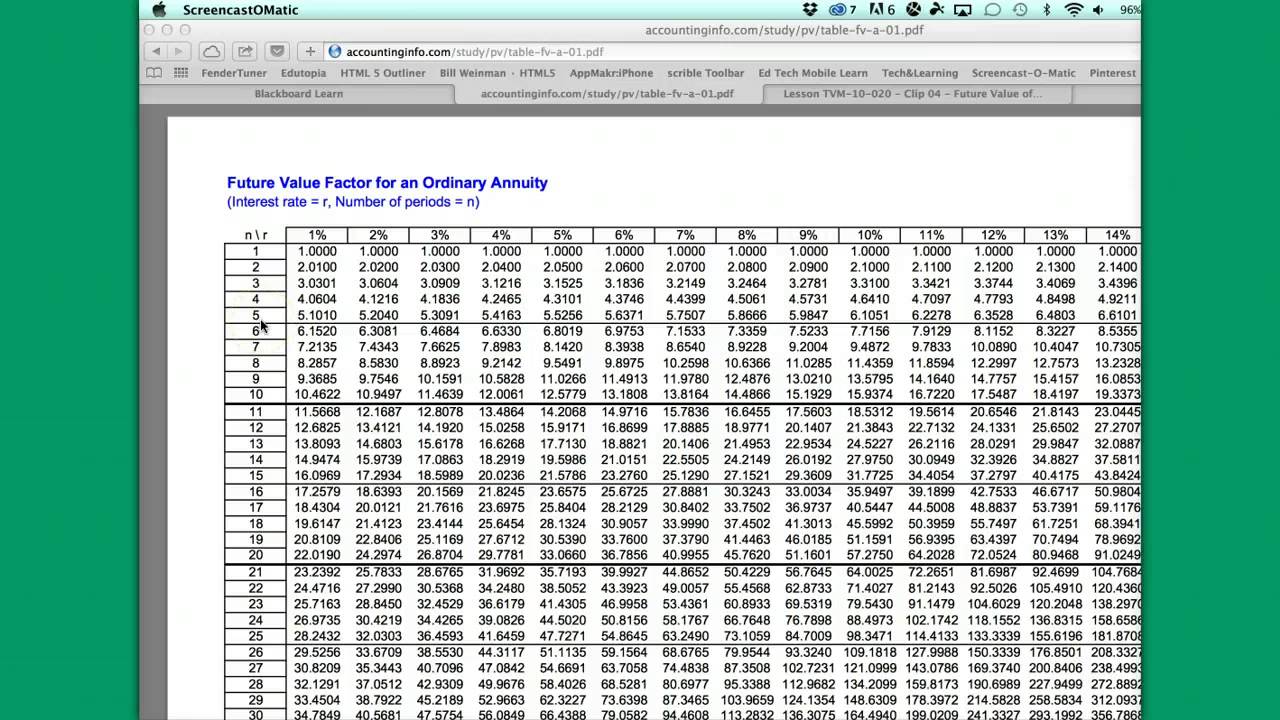

A number of online calculators can compute present value for your annuity. But if you want to figure out present value the old-fashioned way, you can rely on a mathematical formula (with the help of a spreadsheet if you’re comfortable using one). A lower discount rate results in a higher present value, while a higher discount rate results in a lower present value. See how different annuity choices can translate into stable, long-term income for your retirement years. PV (along with FV, I/Y, N, and PMT) is an important element in the time value of money, which forms the backbone of finance.

For example, present value is used extensively when planning for an early retirement because you’ll need to calculate future income and expenses. You must always think about future money in present value terms so that you avoid unrealistic optimism and can make apples-to-apples comparisons between investment alternatives. The net present value calculates your preference for money today over money in the future because inflation decreases your purchasing power over time.

These annuities pay money to you after you fulfill the obligations of the contract. When t approaches infinity, t → ∞, the number of payments approach infinity and we have a perpetual annuity with an upper limit for the present value. You can demonstrate this with the calculator by increasing t until you are convinced a limit of PV is essentially reached. Then enter P for t to see the calculation result of the actual perpetuity formulas. Always keep in mind that the results are not 100% accurate since it’s based on assumptions about the future.

Commentaires récents